Musings on Markets, Strategy, and the Future of Digital Platforms

As wise men have said, “Markets are not precursors, but outcomes of strategy.” That line has stayed with me for years. Every time I see the relentless marketing blitz around us—brands launching, sustaining, expanding, or attempting to shift their orbit—it resurfaces with new relevance. We often marvel at the noise, at the intensity of the push, but rarely pause to ask the question beneath it: How long can these efforts truly sustain without an effective last-mile vehicle to carry them?

The more I observe markets—across categories, channels, and geographies—the more I am reminded that they are not static arenas. Markets are living, adaptive systems, shaped by countless deliberate and accidental actions of diverse actors. When companies set out to “shape markets,” they are essentially attempting to bend this system in their favor. Whether the goal is market maintenance, expansion, new category creation, or innovation, the outcome is ultimately determined by how well strategy translates into execution on the ground.

It is in this translation—from intent to action, from boardroom strategy to outlet-level reality—that digital platforms for secondary sales and distribution now play a decisive role.

The Market as a Living System

Economists often portray markets as efficient mechanisms driven by rational actors. Reality paints a much richer picture. Markets are dynamic, adaptive systems, shaped by incentives, constraints, infrastructure, regulations, and the everyday decisions of millions of actors who may or may not have perfect information.

The fascinating thing about markets is that they change even when we don’t try to change them.

- A supply chain decision in one region alters competitor behavior in another.

- A distributor consolidation creates ripples across neighboring territories.

- A new channel—say, Qcommerce—reshapes consumer expectations far beyond its initial footprint.

But when market shaping is deliberate, it becomes a strategic craft. Companies don’t just participate; they intervene. They:

- Protect existing share (“market maintenance”)

- Push deeper (“market expansion”)

- Create new categories (“new market creation”), or

- Redefine consumption habits (“innovation”).

And yet, in all four scenarios, the same constraint emerges repeatedly: the last mile is the arbiter of strategy. Without the right tools to execute at scale, even the most brilliant market-shaping ambitions collapse under their own weight.

Why Digital Platforms Now sit at the Center of Market Shaping

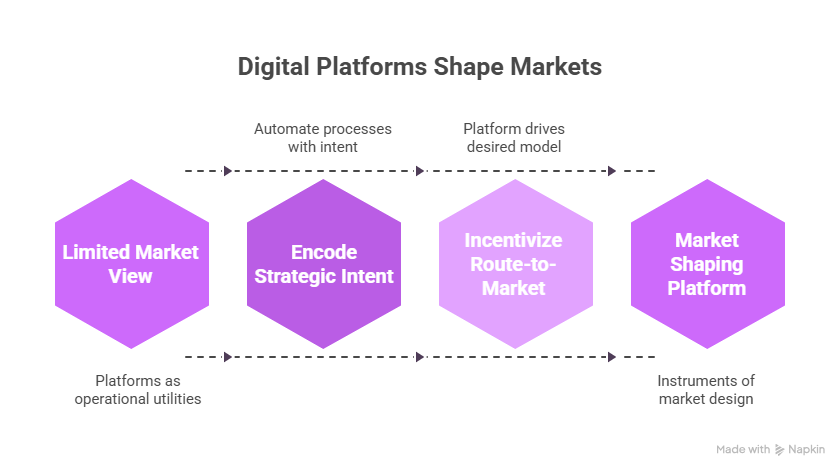

It is tempting to view digital distribution platforms as operational utilities—tools for faster secondary sales updates, inventory visibility, or route planning. But this misses the point.

Done right, these platforms become instruments of market design.

When we build a secondary sales and distribution platform, we are not merely automating processes; we are encoding strategic intent into the operating rhythm of a business. The right platform can:

- Incentivize any route-to-market model

- Encourage more efficient distributor behavior

- Make some channels more attractive than others

- Nudge field teams toward expansion or penetration objectives

- Anticipate shifts in customer demand and supply imbalances.

But for a platform to shape markets, it must possess what I call “sensitivities.” This is not a technical term—it is a product philosophy.

A sensitive platform is not just intelligent; it is situationally aware. It can interpret the nuances of the terrain: distributor capacity disparities, hyper-local demand pockets, channel fragmentation, store maturity, seasonality, and even cultural patterns that influence ordering behavior.

This is the difference between software that works on paper versus software that works in the real world.

The New Terrain: Omnichannel, Reconsolidation, and the Fragmented Consumer

Across India and emerging markets, distribution is undergoing three simultaneous shifts:

1. Reconsolidation of distributor networks

Large FMCG companies are restructuring distributor models—some consolidating for efficiency, others decentralizing for responsiveness. Each model brings its own constraints.

2. Omnichannel becoming the default

The ecosystem now spans:

- Traditional offline retail

- Modern trade

- E-commerce

- Q-commerce

- Social commerce

- D2C experiments

A brand’s “market” is no longer a geography—it is an interconnected mesh of channels, each with its own dynamics.

3. Consumers expecting frictionless movement across channels

Consumers oscillate between discovery on Instagram, ordering through Q-commerce, shopping in Super markets and replenishing via kirana stores. The lines between channels have blurred beyond recognition.

These shifts cannot be managed with yesterday’s tools. They require platforms that are perspicacious—infused with the ability to observe, infer, and act with intelligence.

AI/ML: Between Hype, Hope, and Hard Truths

Everywhere we turn, we encounter the buzzwords: “AI,” “AI/ML,” “intelligent distribution,” “predictive planning,” “smart routing.”

The hype is deafening. The pressure to adopt AI is enormous. And yet, the outcomes are—more often than not—underwhelming.

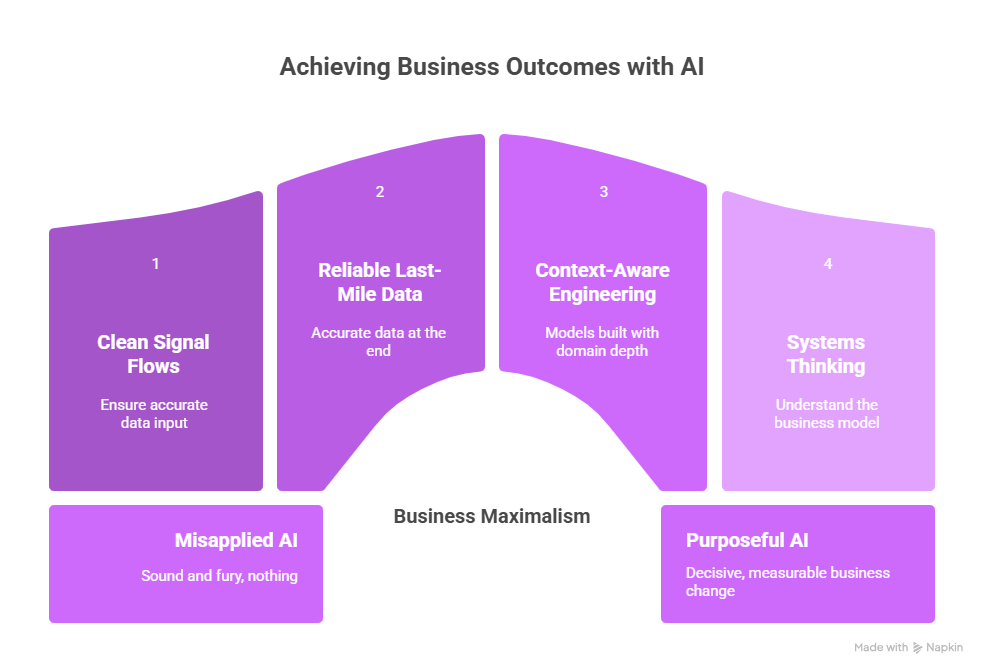

We are, as I often say, in a Macbeth moment: “full of sound and fury, signifying nothing.”

But AI itself is not the problem. The issue is misapplied AI—models built without context, without domain depth, and without the painful lessons of field execution.

The truth is simple: AI is neither a silver bullet nor a sideshow. It is a capability. And like any capability, it needs:

- Clean signal flows

- Reliable last-mile data

- Context-aware feature engineering

- Systems thinking

- And a deep understanding of the business model it intends to support.

Only a handful of teams have truly built meaningful, value-generating AI for distribution. These teams don’t chase buzzwords; they chase business outcomes.

I call this approach “business maximalism.” Technology exists to maximize business outcomes—not technological novelty.

Purposeful AI helps companies:

- Shape demand

- Improve revenue realization

- Optimize capital allocation

- Strengthen outlet-level penetration

- Enhance serviceability across terrain and channel types

This is the real frontier, not AI for demo decks, but AI for decisive, measurable business change.

A Word of Caution: Avoid the Red Herrings

For IT practitioners, product managers, and CTOs modernizing or building new distribution platforms, the temptation to chase trends is real.

The job has not changed. The responsibility remains the same:

Stay anchored to business strategy. Stay anchored to market reality. Stay anchored to last-mile execution.

A few principles worth reiterating:

- Technology cannot outrun broken market structures.

- Fancy features cannot compensate for lack of field adoption.

- AI cannot deliver insights when the underlying data is fragmented.

- Platform design must reflect the economics of distribution—not just the elegance of technology.

- And last-mile tools must work in the environments in which they are deployed—not the environments in which they are designed.

This is how platforms earn trust—from supervisors, from ASMs, from distributors, and from leadership.

In distribution, trust is the ultimate currency. Software either builds it or erodes it.

The Path Forward

We stand at an inflection point.

The forces shaping FMCG distribution today—AI, omnichannel behavior, distributor model shifts, macroeconomic pressures, and the rising cost of last-mile execution—are not stopping anytime soon. Companies that treat these forces as constraints will fall behind. Companies that treat them as design inputs will shape markets for the next decade.

To anyone building or modernizing platforms for the secondary sales and distribution ecosystem, I would advice only this:

- Avoid the red herrings.

- Focus on the fundamentals.

- Build for the last mile, not the demo room.

- And never forget that markets respond to strategy—not noise.

About the Author

Sesh is the COO at Vxceed, where he drives large-scale digital transformation across secondary sales and distribution for global CPG brands. With deep experience in operational strategy and execution, he focuses on building future-ready systems and delivering measurable impact for clients.